Inflation Planning

Protect yourself from a rising cost of living

While some expenses go down as we age and become less active, the cost of living still rises. The costs of medication, health care, food and utilities have historically risen over time. Even modest rates of inflation can make a big difference over time.

Life expectancies are increasing and continue to increase. In fact, Americans are living longer than ever! Nobody knows when our time will come and because of that, we need to plan for longer, healthier lives.

Retirement income solutions are changing and have come a long way since your parents’ generation. This means that we have better ways of ensuring your retirement income for life, no matter how long that may be.

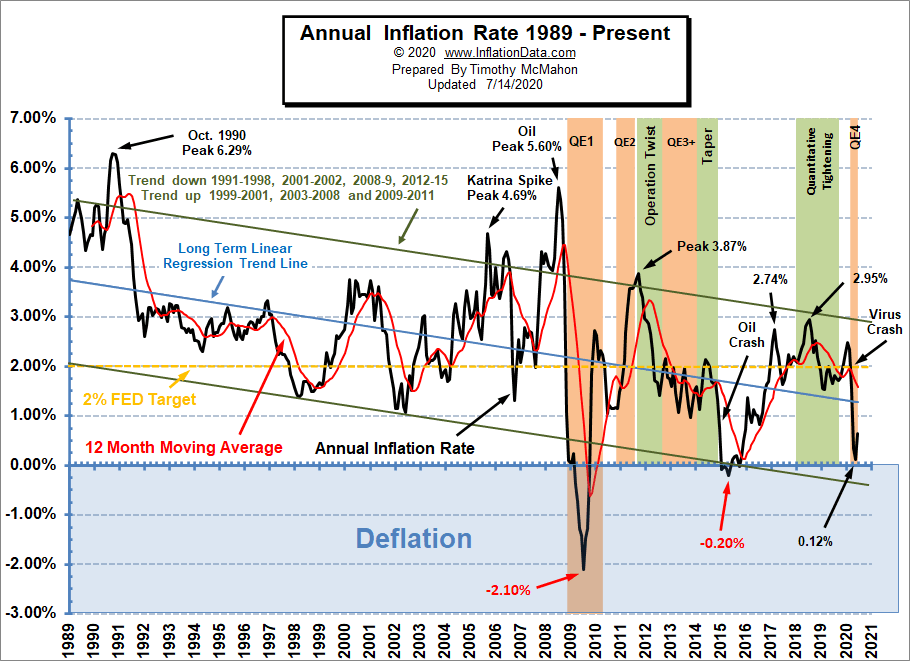

Inflation can have a dramatic effect on your retirement income. At first it may not be very noticeable, but over the course of twenty years or more, inflation may severely limit the purchasing power of a flat income stream. Below is a chart that shows the effects of inflation over a twenty year period and how it could affect the costs of common goods and services in the following years to come.

Even if you are debt free during retirement, inflation can change the price of food, gas, utilities and health care. All of these are necessities during retirement.

In order to help protect yourself from inflation, you may want an income payout that increases over time. This can be done by either hedging more funds before retirement or choosing a product that has the ability to increase payouts based on changes in the Consumer Price Index (CPI).

Protect yourself from a rising cost of living

While some expenses go down as we age and become less active, the cost of living still rises. The costs of medication, health care, food and utilities have historically risen over time. Even modest rates of inflation can make a big difference over time.

Life expectancies are increasing and continue to increase. In fact, Americans are living longer than ever! Nobody knows when our time will come and because of that, we need to plan for longer, healthier lives.

Retirement income solutions are changing and have come a long way since your parents’ generation. This means that we have better ways of ensuring your retirement income for life, no matter how long that may be.

Inflation can have a dramatic effect on your retirement income. At first it may not be very noticeable, but over the course of twenty years or more, inflation may severely limit the purchasing power of a flat income stream. Below is a chart that shows the effects of inflation over a twenty year period and how it could affect the costs of common goods and services in the following years to come.

Even if you are debt free during retirement, inflation can change the price of food, gas, utilities and health care. All of these are necessities during retirement.

In order to help protect yourself from inflation, you may want an income payout that increases over time. This can be done by either hedging more funds before retirement or choosing a product that has the ability to increase payouts based on changes in the Consumer Price Index (CPI).